Rachel Reeves under pressure as UK borrowing higher than forecast in June thanks to soaring debt interest costs

Chancellor Rachel Reeves is facing further pressure over the UK’s public finances after official figures showed higher-than-expected government borrowing last month due to soaring debt interest payments.

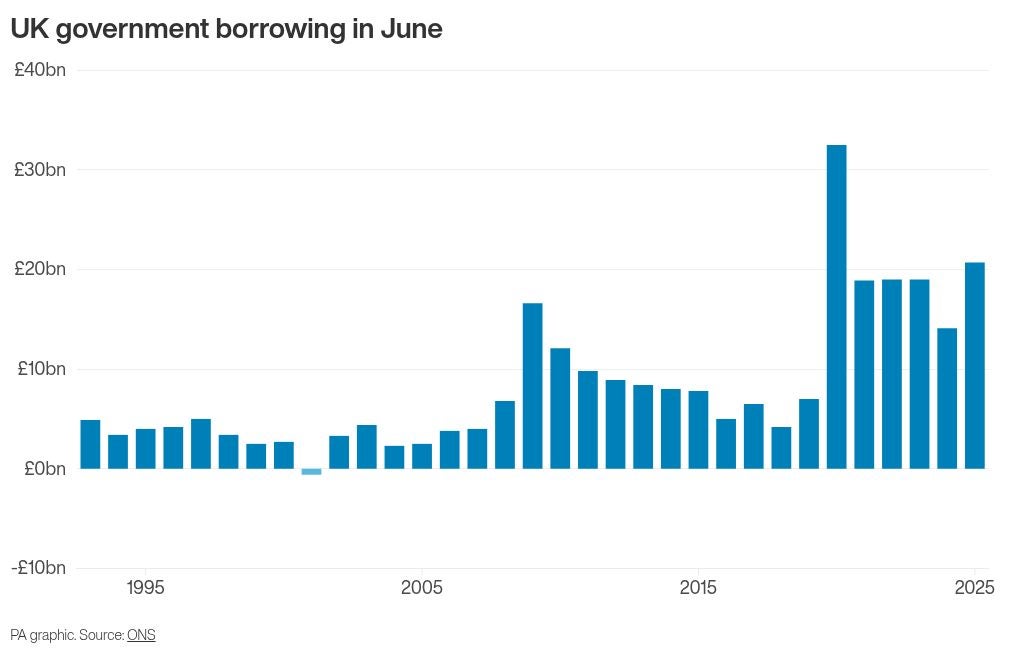

The Office for National Statistics (ONS) said June borrowing rose to £20.7 billion last month – £6.6bn higher than a year earlier and the second highest June borrowing since records began, only behind that seen in 2020 at the height of the pandemic.

The ONS said interest payable on debt jumped to £16.4bn due to a large rise in Retail Prices Index (RPI) inflation impacting index-linked government bonds.

June borrowing was higher than the £17.6bn expected by most economists and the £17.1bn forecast by Britain’s independent economic forecaster, the Office for Budget Responsibility (OBR).

The figures have stoked fears that the government will be forced to hike taxes in the autumn budget, with experts warning over “sin taxes” among measures to help the chancellor balance the books.

Bank of England governor Andrew Bailey told MPs on Tuesday he was “not unconcerned” by increased government borrowing.

But Mr Bailey stressed in the Treasury Select Committee session that it was part of a global trend.

“The cost of borrowing has increased… but the important thing to say is that it is a global phenomenon,” he said.

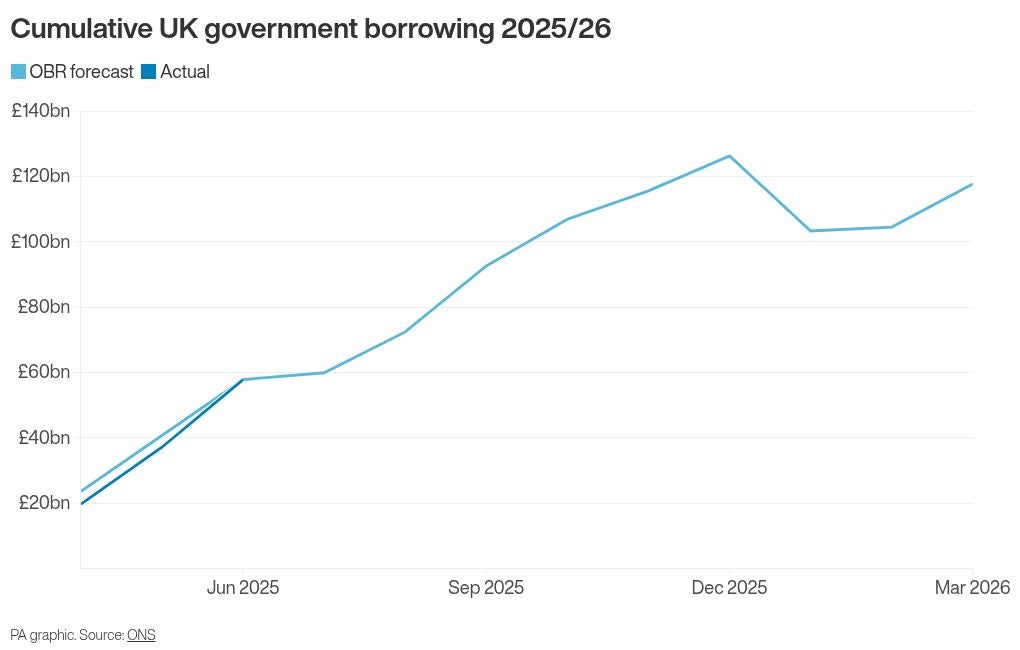

Borrowing for the first three months of the financial year to date stood at £57.8bn, £7.5bn more than the same three-month period in 2024, according to the ONS.

The ONS said so-called compulsory social contributions, largely made up of national insurance contributions (NICs), jumped by £3.1bn to £17.5bn last month – the highest ever recorded for June.

In the first three months of the financial year to date, these compulsory social contributions rose to £48bn, up £7.5bn year on year and marking another record.

It followed the move by Rachel Reeves in April to increase NICs for employers, which has seen wage costs soar for firms across the UK as they also faced a rise in the minimum wage in the same month.

Public sector net debt, excluding public sector banks, stood at £2.87trn at the end of June and was estimated at 96.3 per cent of gross domestic product (GDP), which was 0.5 percentage points higher than a year earlier and remains at levels last seen in the early 1960s.

Darren Jones, chief secretary to the Treasury, said: “We are committed to tough fiscal rules, so we do not borrow for day-to-day spending and get debt down as a share of our economy.”

Economist Rob Wood, at Pantheon Macroeconomics, said the chancellor has a “major problem” to overcome, “created by U-turns on previously planned spending cuts and possible downgrades to OBR growth forecasts this autumn”.

He said: “We estimate that the chancellor’s £9.9bn of headroom has turned into a £13bn hole, meaning that Ms Reeves would need to raise taxes or cut spending by a little over £20bn in the autumn budget to restore her slim margin of headroom.

“We expect ‘sin tax’ and duty hikes, freezing income tax thresholds for an extra year in 2029 and a pensions tax raid – reinstating the lifetime limit on pension pots and cutting relief – to fill most of the hole.”

Shadow chancellor Sir Mel Stride said: “Rachel Reeves is spending money she doesn’t have.

“Debt interest already costs taxpayers £100bn a year – almost double the defence budget – and it’s forecast to rise to £130bn on Labour’s watch.”

Nabil Taleb, economist at PwC UK, said: “The OBR recently reported that the UK now has the third highest borrowing costs among advanced economies and with global uncertainty persisting, particularly around the impact of US policy, the cost of servicing UK debt could climb even higher.”